4 simple steps to track your expenses effectively

No vessel has reached its destination without first knowing the route. Navigators use a variety of instruments to measure the positions of the stars and planets, and to predict the behavior of the waves and currents.

Navigation is an essential skill for any sailor, as it can ensure a safe and successful voyage.

Without a clear objective in mind, it is easy to become lost and wander in the ocean of possibilities.

Set up a saving financial goal

A good way to start is to create a saving financial goal. This will help you stay focused and motivated. Without a goal in mind, it is easy to become distracted and lose sight of your financial goals.

For example, if you want to save $1,200 a year, you would need to set aside $100 every month. This equates to roughly $25 per week, or $3 and a few cents every day.

By putting aside this small amount each day, you will be well on your way to achieving your savings goal.

The formula is simple:

$1200 / 12 months in a year = $100 per month

$100 / 4 weeks in a month = $25 per week

$25 / 7 days in a week ~ $3,60 per day

This means that giving up on a cup of coffee a day can save you 1200 USD per year.

What could you have for 1200 USD?

Start noting down expenses daily

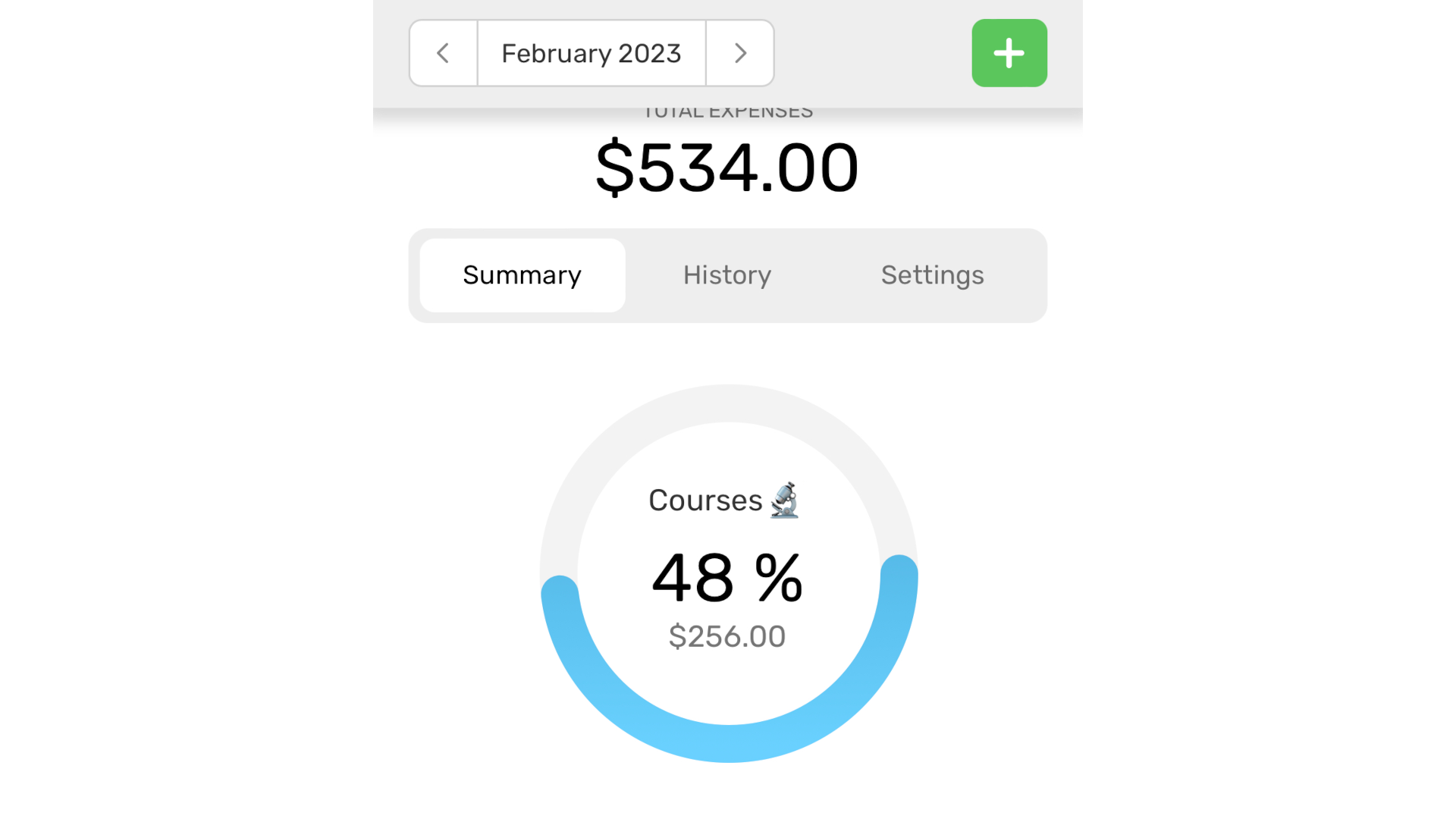

If you want to be successful with budgeting, you need to count your expenses daily. This is easier said than done, but with a little habit formation, Gougou.cash can help you get started.

By tracking your expenses, you’ll be able to see where your money is going and make adjustments as necessary.

This will provide you with a feedback necessary to correct your habits. Gougou is your compass on the journey to financial freedom

Here you're laying the cornerstone for next improvements.

Analyze your personal expenditures

Jane once said:

It was a struggle to keep my expenses low. I had to really focus on basic needs and stick to a budget.

But I had some weaknesses.

For example, I could not resist going out to eat and buying new clothes. And, when it came to home decor, I had a tendency to spend more money than I should.

Though I knew I needed to be more mindful, the temptation to indulge in my small pleasures sometimes overwhelmed me. I could never resist a sale at the mall, nor could I ever pass up an opportunity to dine at my favorite restaurant.

I knew I had to stay within my budget, but it was so hard to understand why I had to be so strict with myself. I tried as best I could to stay disciplined in that constant battle.

I eventually satisfied my desires without breaking the bank, when I stumbled upon the Gougou.cash app.

It solved all my problems with budgeting going haywire.

I could track my expenses in real time and gain a deeper understanding of my spending habits. Every time I noted down an expense, I became more mindful of my budget, and could easily identify where I could make savings.

I could see how much I was spending on entertainment, where I could cut back, and how much I had left.

Another amazing side effect occurred that improved my life.

I started spending more money on experiences rather than material things. I took up yoga classes and went on weekend hikes.

It was a challenge, but I was determined to keep my spending under control.

Today, I am proud of myself for finally gaining control of my finances and securing my future.

The feeling of being able to maintain a balanced lifestyle without succumbing to excess is priceless.

As you can see with the Jane’s story, she struggled to keep her expenses low. The Gougou.cash app allowed her to fulfill desires without busting the bank. After she understood her finances better, she found resources for a new passion.

Constant daily feedback allows you to keep your budget in check.

Find a friend and save money together

Finding a friend or family member to join you on your financial journey is a great way to save money. Working together, you can set goals, hold each other accountable, and provide support and encouragement to help you both reach your financial goals.

Certainly, you can have separate accounts, but you will feel motivated and empowered to learn about financial freedom when you have a unified and integrated approach to managing your finances.

How many people can't stick with exercising after a few weeks? Financial freedom is no different.

We are social creatures and work better in teams.

When you see others achieving their goals, they will inspire you to stay on track and reach your own dreams.

Conclusion

If you’re like most people, you probably keep track of your expenses in your head. But that’s not very efficient. Use Gougou.cash to track your expenses systematically instead.

Here are key takeaways in mind when using Gougou.cash:

- set a financial goal and track daily expenses

- develop good habits with Gougou.cash to stay on track

- analyze your own personal expenditures for better budgeting

- find a friend or family member to join you on your financial journey

We believe in you that you can manage your personal budget. With a little practice, and some guidance from us, you’ll be able to stick to your spending plans and reach your financial goals!